DATE: 01 July 2021, THURSDAYTIME: 7:30PM - 9:30PM (SINGAPORE TIME)

The stock prices rise and you tell yourself, "Okay, this meets my trading rules, let’s go for it."

But right after you buy, the prices suddenly plummet – falling so low that it hit your stop-loss orders, causing you to lose money before hiking back up the charts again.

Despite your best efforts, the sudden price U-turns always seem to catch you unaware and threaten to wipe out your capital.

You begin to lose faith in your trading plan as the market keeps springing surprises that contradict what you learnt in the books and websites.

As we speak, big financial institutions (known as “Market Makers”) are falsifying supply & demand to make retail traders believe the market is moving in their favour.

Once we buy into the market condition they simulated, they turn the charts around and target our stop-loss orders.

… causing 90% of unsuspecting retail traders to lose their hard-earned capital.

I would make a flawed analysis, get stopped out and not know what went wrong. I would get frustrated from making the wrong choices and losing my capital.

But I was passionate about this trade and continued to study the charts relentlessly. At my peak, I traded 16 hours a day.

One day it hit me.

I noticed that large financial players, a.k.a. "Market Makers" were offering large volume orders to drive prices up and down the charts.

They were literally buying and selling to themselves to falsify supply & demand and manipulate market conditions.

By doing so, they could “print” candlesticks and make retail traders buy into the patterns they created. Then they turn around and target our stop-loss orders… you know how the story ends.

Once I realised this open secret, I changed my entire trading strategy.

After > 15,000 hours of live trading and first-hand research, I developed the “XSPY Price Action Manipulation” strategy.

With it, I learnt to enter the minds of Market Makers – how to think like them, know when exactly they will twist prices, and enter and exit my trades beside them.

I stopped second-guessing the market and started making quick and sharp analysis. I created a solid trading plan and followed my rules with discipline and commitment.

After 5 years living the hectic life of a prop trader, I decided to leave the prop desk.

I started the XSPY Trader coaching programme to share my strategy and form a circle of like-minded, serious traders.

“Alson opened up my way of trading. Now I know how the Market Makers think!”

Jess Kang

“Alson’s proven methods will help us improve our returns and accumulate our wealth.”

Alson gave practical examples that highlight his trading experience. The follow-up sessions also help us revise after applying the strategies learnt. Thank you Alson!

Other price action programmes teach you to see price movements — but they don’t show you the manipulation going on behind-the-scenes.

With me, you learn to get into the minds of Market Makers and see the charts like they do.

You no longer have to second-guess the charts and wonder what you did wrong.

Over my prop trading career, I’ve encountered all kinds of market scenarios. I spent >15,000 live trading hours sharpening my skills and learning from bad trades.

This unique strategy is the result of my hard work and research. You will not learn this from any trading websites or books.

Come to my free workshop and hear it for yourself.

Having attended some unpleasant trading programmes, I was hesitant about pouring money for yet another “trading strategy”. Everyone has some strategy that can work in some conditions.

But I found Alson to be refreshingly humble and honest. He makes his students feel comfortable when answering our questions.

What sets him apart is that he’s a true professional who is helpful, sincere and patient. He knows his stuff and he knows stuff that other trainers (self-taught gurus) do not.

The best part of the programme was learning the secrets of market maker psychology, their intentions and actions. I’m glad I joined Spytrader Futures.

Chris Chua

Legal Counsel

“No sales talk — just pure trading talk, pure price action strategy.”

“Attend XSPY Trader to enhance your trading edge.”

“I enjoyed the step-by-step guideline on trading futures, including the set-up of basic screens and software setting.”

Derek Lim Chiong Huat

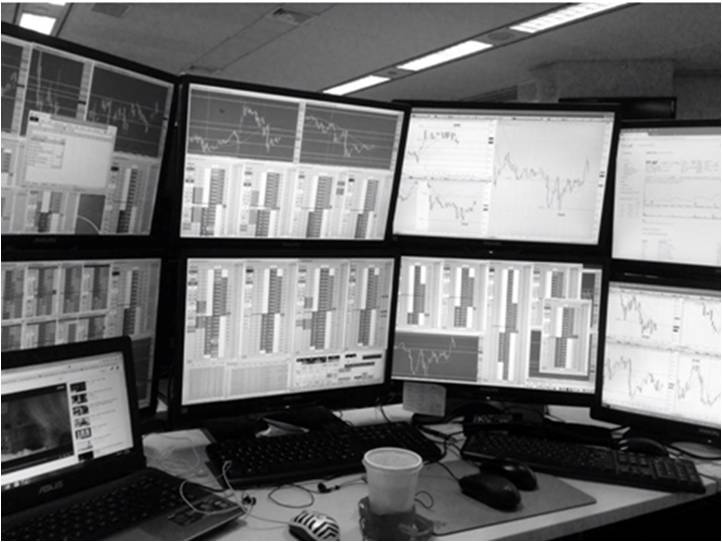

Why clutter your screens and overwhelm yourselves with slow indicators, when you can actually

read clean charts based on the only indicator that matters — PRICE.

Here’s what my

students and I see every day:

I’ll be honest with you here. I’m a trader by profession, not a speaker/salesman.

This means I don’t have a glib tongue and I’m not good at hyping people up with millionaire dreams and get-rich-quick guarantees.

My strategy is especially powerful for serious traders who want to make an income through trading.

It is not recommended for lazy people who want to make easy money without effort.

But if you're looking for an honest coach and a straight-to-the-point trading strategy, I sincerely invite you to learn more at my FREE workshop.

There'll be no oily sales pitches – just honest sharing of my trading tactics and a rare glimpse into proprietary trading practices.

Alson Chew